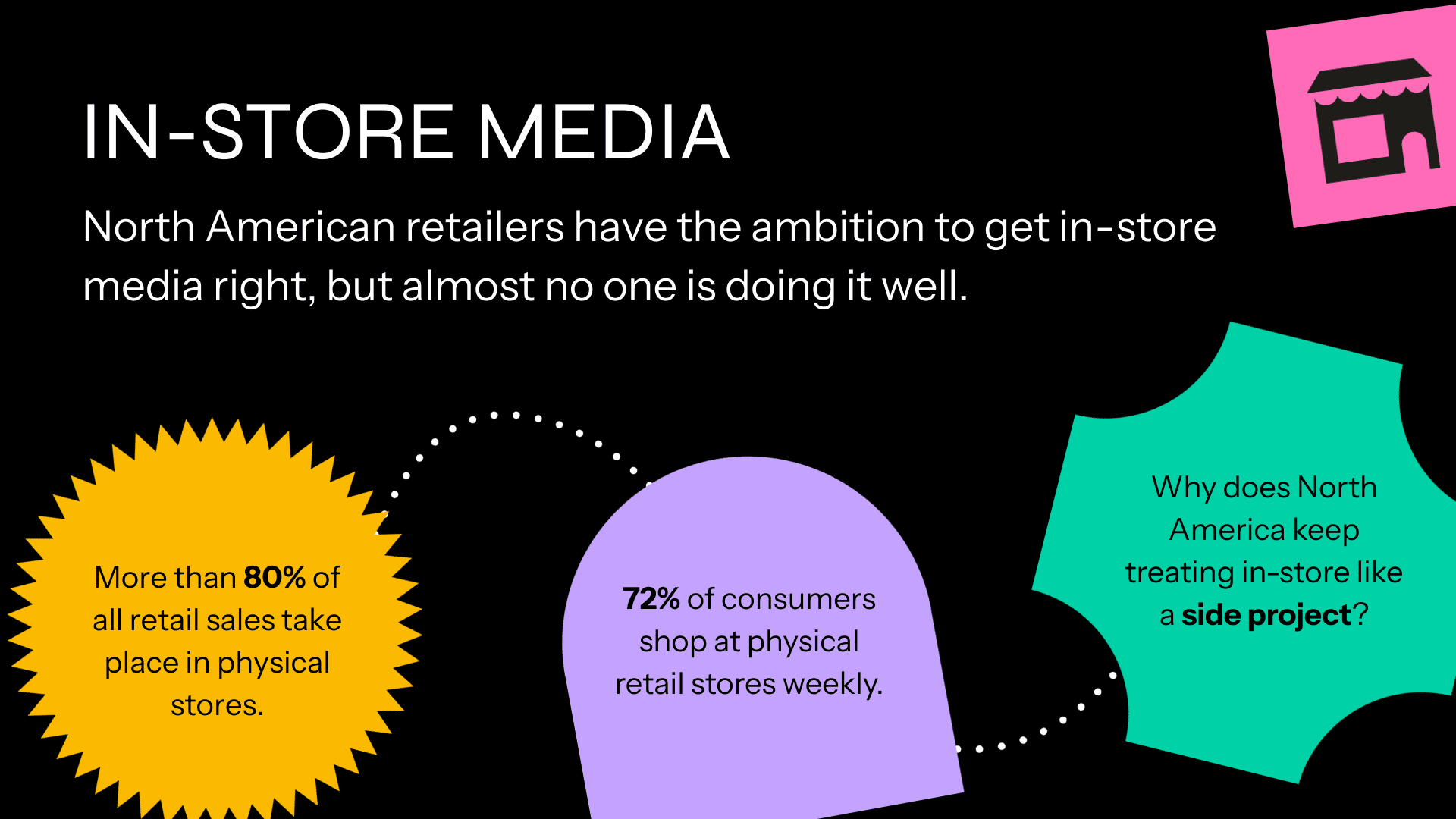

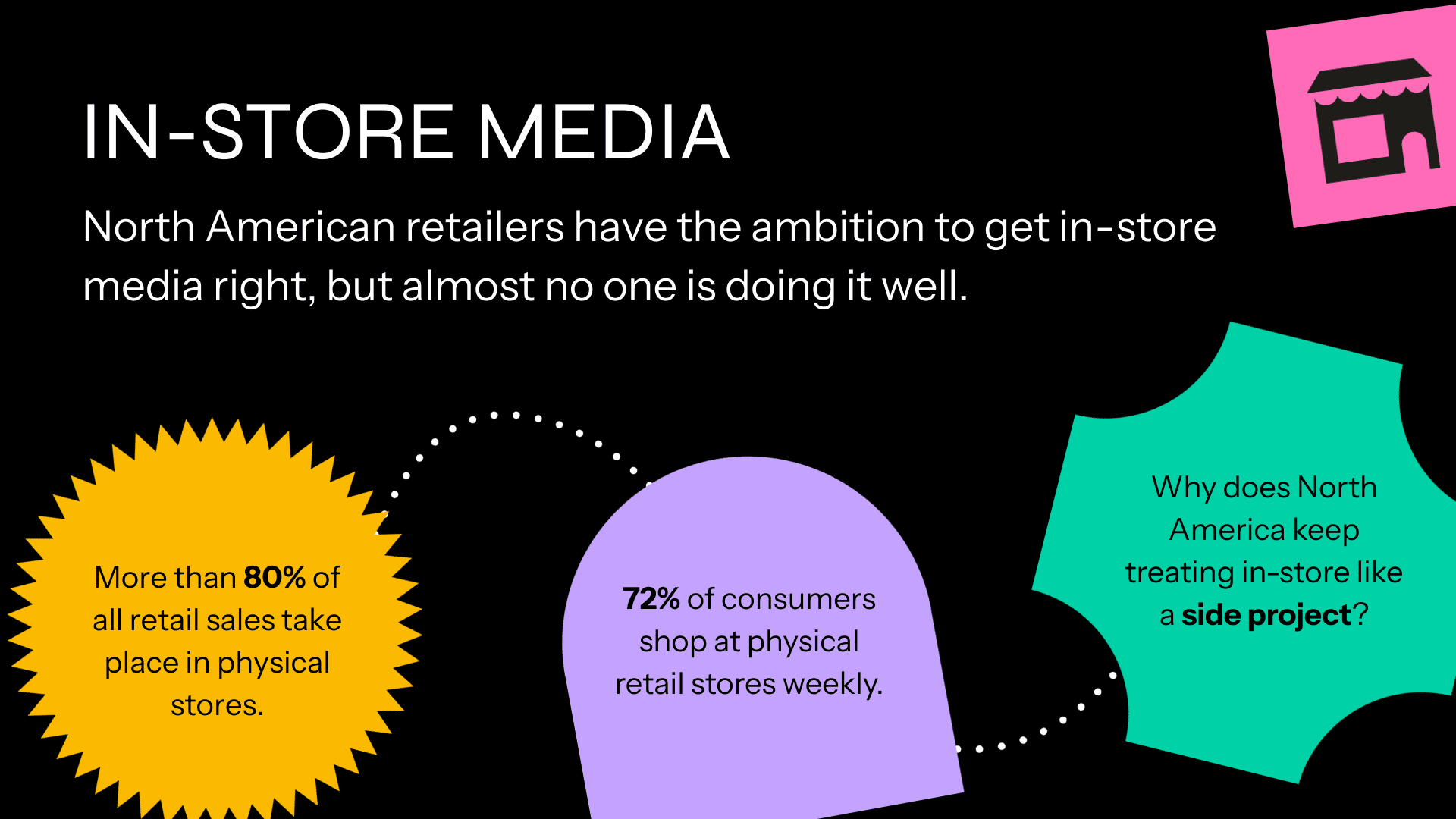

As I walked through the aisles of numerous retailers over Labor Day weekend, one thing was clear: in most cases, the store still does the heavy lifting. But don’t just take my word for it. In the U.S., 83.7% of retail sales in 2024 happen in physical stores and 72% of consumers shop in-store weekly. Put simply: the shopper’s attention—and the brand’s next dollar—are still up for grabs at the shelf. So why does North America keep treating in-store like a side project?

What North America is getting wrong (and why it matters now)

After two years stateside, here’s my read: retailers have the ambition to get in-store right—but almost no one is doing it well. Why? As I told our team recently, “people are intimidated by the store. They think rolling out a retail media network in-store is too complicated… and it can’t be measured.” That fear breeds a narrow response: bring what we know (digital) into the store and call it a day.

Screens? Powerful. Audio? Underrated. But that’s not the end of in-store retail media—it’s one slice. The prevailing model is siloed (“What do we do on screens? On audio? On site?”) with inventory owners selling their channel rather than planning to a KPI. The result is a patchwork of placements that don’t match the trade plan, stock position, or shopper mission.

We’re also stuck on a measurement myth. “Perfection shouldn’t be the enemy of good,” I’ve said more than once. The industry’s obsession with one-to-one, closed-loop precision is holding in-store back. You can prove incrementality and ROI through disciplined test/control at store level—today. Chase perfect later; bank progress now.

What Europe got right (and where the U.S. can leapfrog)

In the UK and Europe, retail media started in the store, not on site/off site. Loyalty programs like Tesco Clubcard and Nectar turned first-party purchase data into planning fuel long before screens arrived. That DNA forced a shopper-first, operations-aware approach: use data to decide which stores, which weeks, which adjacencies—and why. It’s not glamorous; it works.

Geography helped (fewer stores, fewer regions), but the core lesson travels: treat in-store as a cohesive shopper experience, not a set of competing sales quotas.

In-store is not just conversion—it’s brand

We’ve measured thousands of campaigns at SMG through Plan-Apps across categories and retailers. The pattern is consistent: in-store drives both sales and brand. When you get beyond “stick it everywhere” and plan to KPI, you see meaningful gains in awareness, salience and recall—right where decisions are made.

Two quick proof points worth your time:

- Small-format advantage. Co-op’s attention study with Lumen found in-store media in convenience formats delivered 2× opportunity to see, ~3× attention, and ~4× brand recall versus large-format stores. In other words, tight footprints concentrate attention, gold for brands fighting habitual baskets.

- Experience lifts performance. A recent digital signage study reported a 60% jump in “store delight,” which correlates with dwell and conversion. The point isn’t the technology itself, it’s how it’s leveraged to engage shoppers.

And because products are typically priced lower in grocery and beauty, in-store economics outperform digital for trial and impulse, especially in these verticals. As I like to say, “the store is the last mile of persuasion.”

Why the U.S. under-invests, and the opportunity hiding in plain sight

Follow the money and you’ll see the gap: U.S. omnichannel retail media will surge in the next few years, yet the vast majority of spend is still pointed at digital channels. Meanwhile, 85%+ of transactions still involve a store. That’s a misallocation problem, not a market problem.

The good news: this isn’t a billion-dollar CapEx prerequisite. You don’t need it across every store, and you absolutely shouldn’t wait. Pilot smartly; scale deliberately.

What changes inside the retailer

None of this lands without structural governance change. As I’ve said, retailers are excellent at buying and selling stuff. They’re not, by default, media companies. That’s fine. Bring in operators who’ve done this before (yes, this is where I plug SMG), align incentives around total retailer P&L, and you’ll unlock both top-line sales and high-margin media revenue. Even a 0.1-point move on retail margin is meaningful at scale.

The bottom line

Everyone keeps saying the next 20 years of retail media are in-store. They could be—but only if we stop thinking about screens and start thinking about strategy. “Stop obsessing about one-to-one measurement,” plan to KPIs, and treat the store as the beating heart of an omnichannel campaign.

The shoppers are already there. It’s time the media caught up.

The in-store experts

How can SMG help you achieve your commerce media goals with in-store?